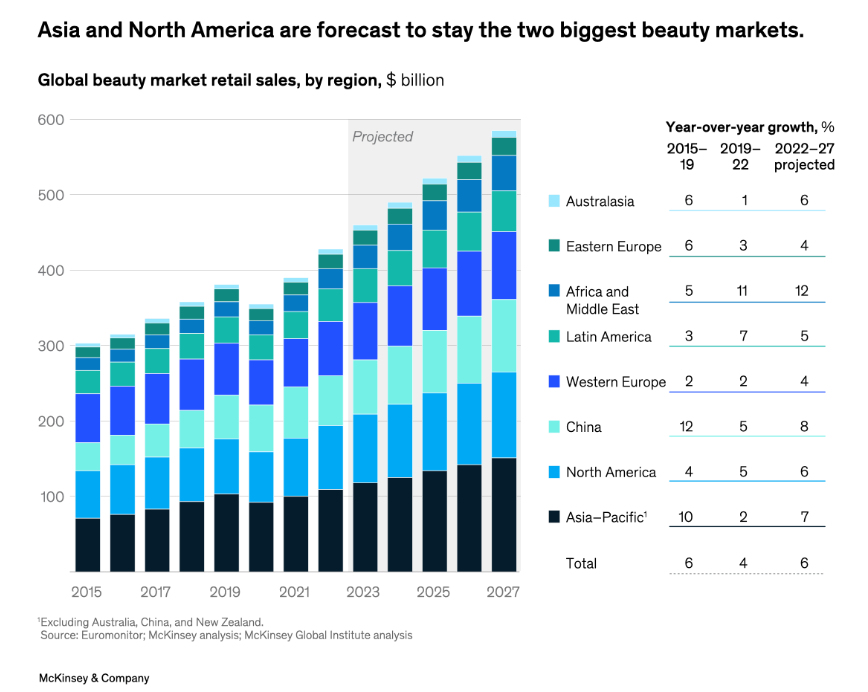

June 27, 2023After weathering the COVID-19 pandemic and a turbulent macroeconomic environment, the market for beauty products is projected to grow by 6 percent a year to reach approximately $580 billion by 2027. But senior partners Achim Berg and Kristi Klitsch Weaver find that while brands have long focused on the top two markets—China and the United States—they should now be prepared to diversify geographically to other countries and regions, including the Middle East and India, which offer distinct potential for specific categories and price tiers.

The glow of the beauty industry has proved hard to resist, attracting many new companies and investors. Brands must make differentiating choices to find success in this shifting and increasingly competitive landscape.

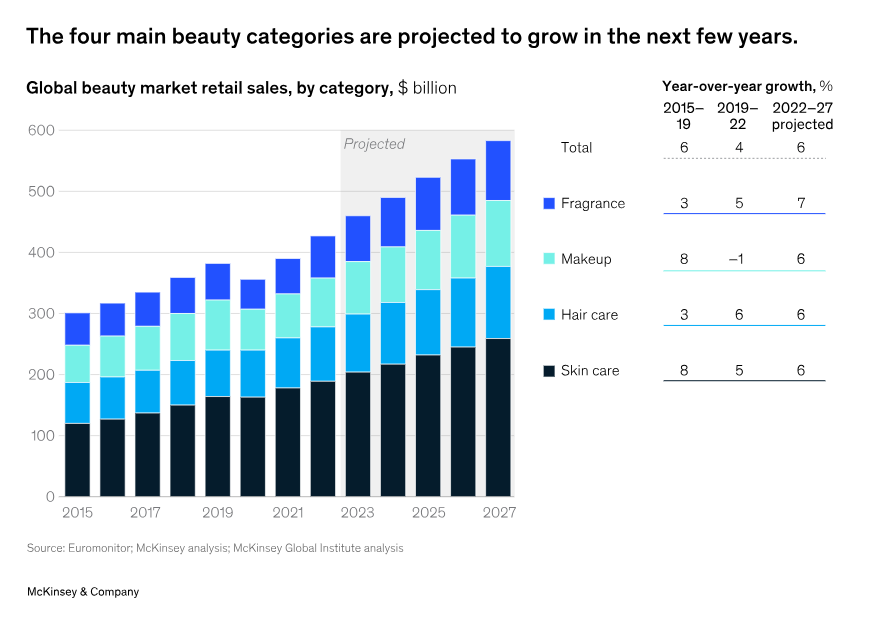

In 2022, the beauty market—defined as skincare, fragrance, makeup, and haircare—generated approximately $430 billion in revenue. Today, beauty is on an upward trajectory across all categories. It has proven to be resilient amid global economic crises and in a turbulent macroeconomic environment. Beauty is now an industry that many people, from top-tier financiers to A-list celebrities, want to be a part of—and with good reason. Following a solid recovery since the height of the COVID-19 pandemic, the beauty market is expected to reach approximately $580 billion by 2027, growing by a projected 6 percent a year (Exhibit 1). This is in line with or slightly higher than other consumer segments such as apparel, footwear, eyewear, pet care, and food and beverages.

A dynamic segment that is ripe for disruption, the beauty industry will have reshaped itself around an expanding array of products, channels, and markets before this decade is over. Consumers, particularly younger generations, will spur this shift, as their own definitions of beauty morph while their perceptions of everything—from the meaning of sustainability and the role of influencers and key opinion leaders to the importance of self-care—evolve. Overall, beauty is expected to be characterized by “premiumization,” with the premium beauty tier projected to grow at an annual rate of 8 percent (compared with 5 percent in mass beauty) between 2022 and 2027, as consumers trade up and increase their spending, especially in fragrance and makeup.

At the same time, we expect the landscape to become even more competitive, as a range of independent brands that successfully came to market over the past decade seek to scale and as new challengers emerge. Intensifying competition will prompt incumbent brands and retailers to change as well. In line with the trend-driven dynamics in the market, 42 percent of respondents to McKinsey’s 2023 survey of consumers across China, France, Germany, Italy, the United Kingdom, and the United States say they enjoy trying new brands. Meanwhile, consumers are increasingly shopping across price points and report that both online and offline stores influence their shopping behavior. Their preference for omnichannel shopping is expected to continue to fuel legacy brands’ shift online and independent labels’ move into a brick-and-mortar presence.

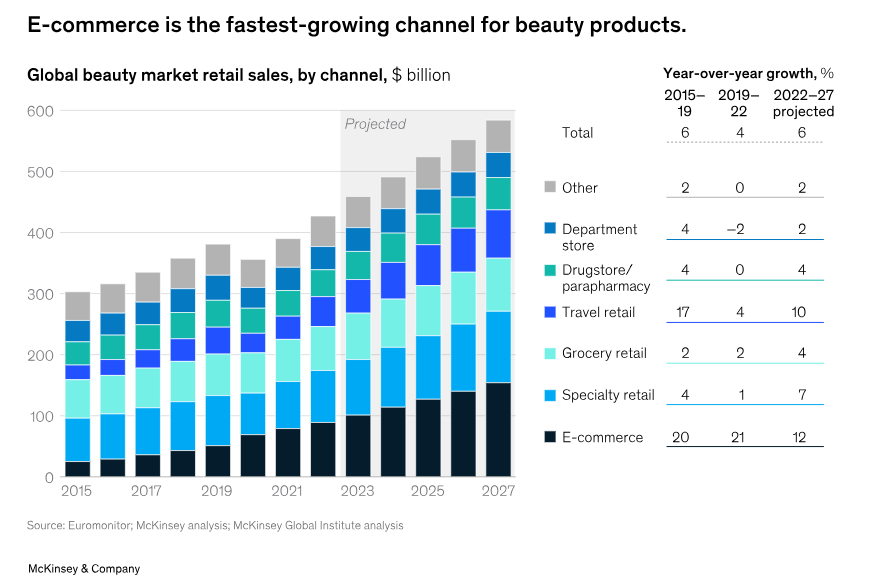

E-commerce in beauty nearly quadrupled between 2015 and 2022, and its share now exceeds 20 percent, with significant runway ahead. This compares with a 2022 e-commerce share of approximately 30 percent in apparel and footwear, and around 65 percent in toys and games.

A number of factors have fueled e-commerce growth in beauty: the expansion of beauty offerings from online giants like Amazon in the United States and Tmall in China; the increased digital sophistication from direct-to-consumer players; the steadily growing significance of online for omnichannel retailers; and the proliferation of social selling, including livestreaming, in Asia. E-commerce is expected to continue to be the fastest-growing sales channel, at 12 percent per year between 2022 and 2027, but growth in traditional channels—including specialty retail, grocery retail, and drugstores—is expected to pick up postpandemic, as consumers’ preference for omnichannel is partly driven by their continued desire for in-store discovery and trial of products (Exhibit 2). Department stores are expected to continue to lose market share globally.

I hope this helps you.

Article source: McKinsey & Company