Report Overview

The global hair dryer market size was valued at USD 8.57 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.0% from 2023 to 2030. The key factors driving the demand for hair dryers are the improving standards of living and greater emphasis on physical appearance. Evolving fashion trends in hair care and styling, coupled with rising hair styling trends featured in movies and on fashion runways, are considerably impacting the sales of hair dryers globally, across all age groups. Hairdryers help style, curl, straighten, volumize, or flatten the hair using heat.

An increasing number of professional salons across the globe is expected to be the key factor driving the sales of hair dryers. In addition, rising awareness about personal grooming is propelling product demand. Major salon chains are investing in the developing regions of Asia Pacific to increase their customer base and a number of salons are opting for professional hair appliances, including hair dryers. Thus, the rising number of professional hair salons, particularly in emerging markets, is anticipated to contribute to the growth of the market over the forecast period.

An increase in spending by consumers on professional salons and hair styling tools is expected to open new avenues for market growth. Consumer expenditure on professional salons and hairstyling tools is driving the global hair dryer industry’s expansion. With the growing popularity of social media, beauty trends have changed a lot, which has led to a surge in demand for hair dryers. According to the Philips Global Beauty Index 2019, nearly 76% of women used a hair dryer regularly. Such trends will lead to the high adoption of hair dryers by consumers.

Manufacturers are increasingly spending on technology, sponsorships, and partnerships to widen their customer base and are operating on a high-profit margin. Big brands, companies offering premium products, and players with a large customer base and global presence have an average markup between 35% and 50% on hair dryer products. Changing preferences are expected to play a significant role in determining the profit margins within the industry.

Companies in the industry typically sell their products through distribution channels such as retail stores as well as through independent or company-owned dealers. Large companies in this industry operate globally and generate revenue from multiple regions. For instance, Koninklijke Philips N.V. derived 58% of its revenue from North America in 2020, 13% from Latin America, 22% from Europe, the Middle East, and Africa, and 7% from Asia.

There were several concerns regarding hair dryers spreading COVID-19 viruses, which reduced their use during the pandemic. In May 2020, in Connecticut, the government announced that state hair salons could reopen but suggested a ban on blow-dryers or hair dryers, as they could circulate COVID-19 particles in the air. Though blow-drying is an almost essential service in a salon, it was regarded as a potential medium to spread the virus throughout the space, which impacted the use of hair dryers among hair stylists and consumers during and immediately after the pandemic.

Product Insights

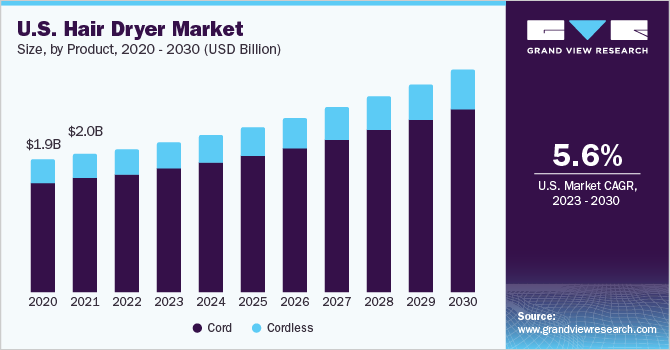

The coded product segment held the largest share of over 83.0% in 2022. Generally, corded hair dryers are preferred for use in households and professional services, unless they are being used for traveling or other purposes where portability is required. Corded hair dryers are also more powerful than cordless ones and can dry the hair more quickly. They have better airflow and heat settings, due to which they are preferred by consumers.

As consumer needs change with time, manufacturers are launching enhanced hair dryers to suit varied needs. For instance, in September 2021, U.S. brand Shark, owned by SharkNinja Operating LLC, launched the Shark HyperAIR Hair Dryer, which is equipped with HyperAIR IQ technology. It combines high-velocity heated air and ionized air for ultra-fast drying, no heat damage, and long-lasting styles. The launch of such products is expected to positively impact the corded hair dryer market.

On the other hand, the cordless product segment is expected to register a significant CAGR of 6.3% during the forecast period. Cordless hair dryers are preferred by some consumers as they are portable, lightweight, and convenient to use. They are mostly preferred while traveling as they are easy to carry and do not require power outlets as they are battery-powered. These factors are fueling the demand for cordless hair dryers.

However, a cordless hair dryer is not as powerful as a corded one as it is powered by batteries, resulting in weak airflow and lower heat settings. This takes a longer time for the hair to dry completely. Furthermore, cordless hair dryers do not last as long as corded hair dryers as the battery life is limited. As a result, cordless hair dryers cannot replace standard corded hair dryers, except in certain situations, such as places where there is no electricity.

Application Insights

The individual segment dominated the market and captured a revenue share of over 61.42% in 2022. The use of hair dryers has become fairly common in developed countries-and generally in urban households. Growing urbanization across the globe has contributed to the rising sales of hair dryers for personal use. According to World Bank data, the global urban population grew from 3.57 billion in 2010 to 4.36 billion in 2020.

Social media has played a significant role in rising beauty standards around the world, and this has generated an increased demand for personal care products like hair dryers. Social media platforms like TikTok are accelerating the sales of hair dryers as a lot of young consumers are buying hairstyling and beauty products after watching video tutorials and reviews by leading influencers. Such social media platforms serve as brand engagement and marketing tools for hair dryer companies, contributing to increased product penetration.

The professional segment is expected to register significant growth during the forecast period. With the rise in disposable incomes and increased beauty standards of the modern world, the trend of visiting hair salons to style hair has been growing in recent years and hair salons are witnessing a higher footfall. This has fueled the demand for professional hair dryers.

According to the U.S. Bureau of Labor Statistics, there were 622,700 barbers, hairstylists, and cosmetologists in the U.S. in 2020. As per the Bureau, this number is projected to reach 742,400 by 2030, growing by 119,800, or 19%. In the UK, the number of hair salons increased by 21% over five years from 2014 to 2019, reaching a total of 16,559 hair salons in 2019, according to the UK’s National Hair & Beauty Federation (NHBF).

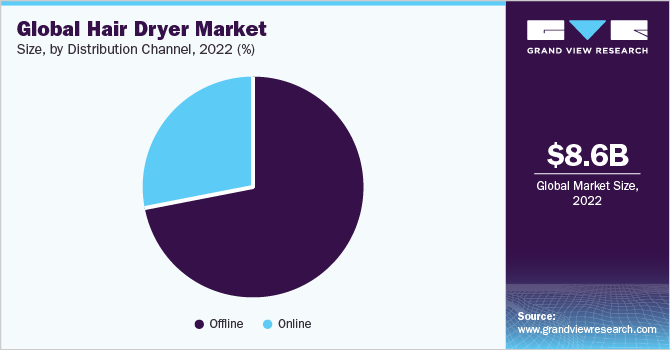

Distribution Channel Insights

The offline segment dominated the market and held a revenue share of over 72.05% in 2022. The offline channel is the most widely used channel for purchasing a hair dryer. Offline stores provide consumers with the option of testing the operations of a product before making a purchase decision. Hair dryers from offline channels are generally purchased from electronics retail stores or beauty & cosmetic stores. For instance, an India-based electronic retail chain, Croma, sells consumer electronics including grooming and personal care products like hair dryers. It offers a large variety of hair dryers from all kinds of brands including Dyson and Philips, among others.

The online segment is expected to exhibit the fastest CAGR of 6.3% over the forecast period. Since the onset of the COVID-19 pandemic, the demand for hair dryers from e-commerce platforms increased as physical stores remained closed for some time. Even after the effect of the pandemic subsided, people were reluctant to visit these stores, which bodes well for online channels. As consumers slowly began relying on online platforms for purchasing hair dryers, the demand from e-commerce platforms gained traction.

Furthermore, the busy lifestyles of the modern world have given rise to consumers looking for time-saving options while purchasing products like hair dryers, thereby attracting more consumers toward online purchases. Along with the availability of a wide range of hair dryers, consumers often rely on reviews for the product available on e-commerce platforms, which helps them in making a purchase decision.

Regional Insights

North America accounted for the largest revenue share of over 34.0% in 2022. The region has the largest market for hair dryers in the world, particularly owing to a large number of consumers who are more aware and conscious about personal grooming and self-care. Furthermore, as consumers in North America have a higher disposable income compared to the rest of the world, especially those in the U.S. and Canada, the tendency of purchasing high-end hair dryers is greater in the region.

As a result, market players in North America are launching advanced and premium products, in response to the high demand from consumers. For instance, in January 2021, Panasonic Corporation of North America introduced the Panasonic nanoe Hair Dryer (EH-NA67-W). The hair dryer uses patented nanoe technology to provide the extra moisture that it draws from the air and protects the hair from damage. The product, priced at USD 149.99, comes with an oscillating quick-dry nozzle, which evenly distributes the heat.

Asia Pacific is expected to expand at a high CAGR of 6.5% during the forecast period. The growing disposable income of the population in Asian countries is increasing the adoption of personal care appliances such as hair dryers among consumers. Furthermore, the growing urban population is fueling the sales of hair dryers in the region. According to World Bank data, the urban population in the East Asia and Pacific region rose from 1.29 billion in 2015 to 1.43 billion in 2020.

The launch of new hair dryers in the market with advanced features is expected to further fuel the demand from consumers. In November 2020, Koofex, a brand owned by the hair care appliances company, Guangzhou Haozexin Technology, launched its new Leafless Hair Dryer CF-6090 at the leading Asian beauty trade fair, Cosmoprof Asia Digital Week. The hair dryer is equipped with a built-in negative ion hair care that provides a tangle-free blow-dry experience.

Key Companies & Market Share Insights

The major players account for a considerable market share and have a strong presence across the globe. It also comprises small- and medium-sized local players who offer a selected range of products at much cheaper rates and mainly serve regional customers. Global brands face tough competition from these players since smaller players have a better grasp and reach in regional or country markets.

The impact of major players is quite high as a majority of them have vast global distribution networks to reach out to a large customer base. However, the majority of the new companies in the market are focusing on introducing new and innovative products to address the evolving needs of customers and to gain a competitive edge over other players. For instance, in January 2021, Panasonic Corporation launched the Panasonic nanoe hair dryer, which features an oscillating quick-dry nozzle and the company’s patented nanoe technology for easy styling and healthy hair.

- In June 2022, Dyson launched an upgraded version of the Dyson Airwrap. Numerous changes and additions have been made to the styler; it is now compatible with different hair types and textures and includes a range of attachments. Users of the airwrap can curl, wave, smoothen, and dry their hair without using a lot of heat due to the use of a quick and high-pressure motor, which also shortens the styling process.

- In July 2021, Realme TechLife partnered with Dizo Lifestyle to launch a white Realme hair dryer and Realme trimmer series in India. The hair dryer functions at temperatures below 55 degrees. It has four physical buttons, including the Off, Soft Air, and Cold Air buttons. Inlet mesh, nylon mesh, and an air inlet grille are also included with the dryer.

- In February 2020, Ghd Hair (Jemella Ltd.) gave its original IV styler an upgrade with improved technology and unique features like a ceramic plate, stylish design, lighter weight, matte back coating, and rounded edges. The product was priced £10 higher than the older version.

Some prominent players in the global hair dryer market include:

- Conair LLC

- Panasonic Holdings Corporation

- Koninklijke Philips N.V.

- Dyson Limited

- Tescom Co., Ltd.(Tescom Denki Co., Ltd)

- Spectrum Brands, Inc.

- Revlon Inc.

- Ghd Hair (Jemella Ltd)

- Harry Josh Pro Tools

- Braun GmbH (A brand of Procter & Gamble)

Global Hair Dryer Market Report Segmentation

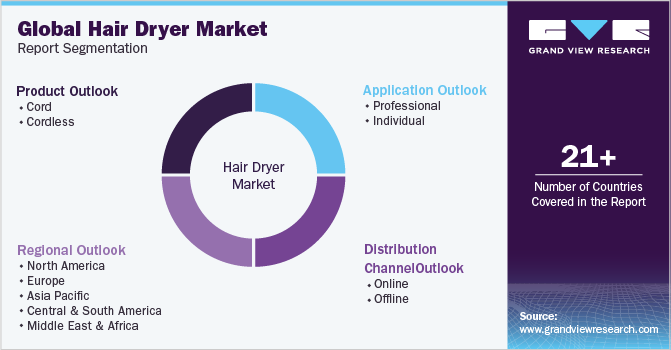

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global hair dryer market report based on product, application, distribution channel, and region:

- Product Outlook (Revenue, USD Billion, 2017 – 2030)

- Cord

- Cordless

- Application Outlook (Revenue, USD Billion, 2017 – 2030)

- Professional

- Individual

- Distribution Channel Outlook (Revenue, USD Billion, 2017 – 2030)

- Online

- Offline

- Regional Outlook (Revenue, USD Billion, 2017 – 2030)

- North America

- U.S.

- Europe

- Germany

- UK

- France

- Spain

- Asia Pacific

- China

- India

- Central & South America

- Brazil

- Middle East & Africa

- North America

I hope this article is helpful to you.

Article source: Grand View Research